- Chasing Money

- Posts

- Nvidia's 2025 Vision: AI Dominance or Disruption?

Nvidia's 2025 Vision: AI Dominance or Disruption?

Picture this: 1993, a Denny's in San Jose, the air thick with the scent of pancakes and ambition.

Three engineers, Jensen Huang, Chris Malachowsky, and Curtis Priem, are huddled, dreaming big.

Their mission? To revolutionize graphics processing. Their budget?

A measly $40,000. They start coding, labeling everything "NV" for "next version."

Time to incorporate arrives, and "NVision" seems perfect, until they discover it's already trademarked.

... by a toilet paper company!

Huang, inspired, suggests Nvidia, channeling a bit of "envy" as in, what everyone will feel for their tech.

Fast forward, and their first product, the NV1, is a quirky flop.

Sega even turns them down for the Dreamcast. Ouch! But then, a lifeline!

Sega's president, Shoichiro Irimajiri, sees something special and invests $5 million, giving Nvidia a critical six months to survive.

The pressure is on. They bet everything on the RIVA 128, a chip optimized for triangles (the building blocks of 3D).

As launch day approaches, Nvidia has barely enough cash for one more payroll. Seriously, they were THIS close to folding.

It got so bad, their motto became, "Our company is thirty days from going out of business."

Then, BAM! The RIVA 128 hits the market and sells a million units in four months. Saved!

From near-certain doom, Nvidia used its renewed revenue to develop the future.

Nvidia is the king of AI computing. It started with gaming GPUs. Now, it fuels AI, data centers, and autonomous vehicles.

Gif by NVIDIA-GeForce on Giphy

Explosive Financial Growth

Nvidia’s numbers are mind-blowing.

Here’s a snapshot:

Revenue Growth: 94% jump to $35.1 billion.

Data Center Boom: 112% YoY growth, hitting $18.4 billion in Q4 2024.

Earnings Per Share: $0.78, up 111% YoY.

Shareholder Payouts: $11.2 billion in buybacks and dividends.

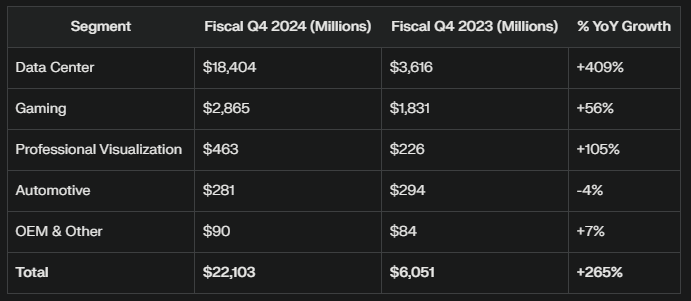

Nvidia’s Revenue Breakdown

The Data Center platform is driving the vast majority of Nvidia's growth, showcasing its strength in the AI and cloud computing space.

While Gaming and Professional Visualization are growing, Automotive is lagging.

The projections highlight the increasing importance of the Data Center platform to Nvidia's future.

Keep in mind that these projections assume that the growth rates remain constant, which may not be the case in reality.

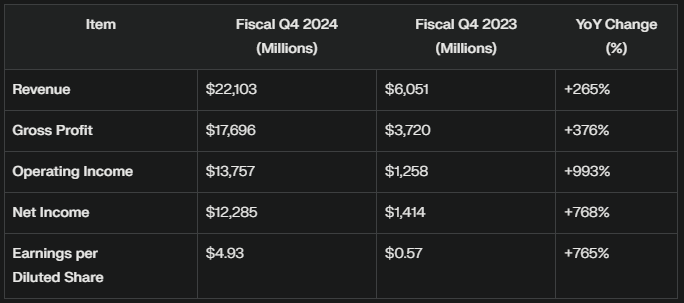

Income Statement Summary (GAAP)

Nvidia's profitability has skyrocketed, driven by AI-driven demand.

Below table shows a simplified view of Nvidia's Income Statement, comparing Q4 2024 to Q4 2023.

Nvidia had a strong Q4 2024, with big jumps in revenue and profit.

The company is making money more efficiently than before. Its success comes from booming AI demand and strong data center sales.

CEO Jensen Huang said, “Accelerated computing and generative AI have hit the tipping point.”

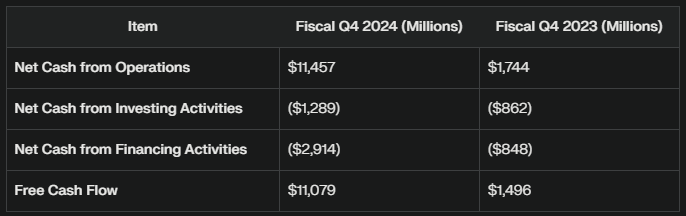

Cash Flow Statement Summary

A significant increase in cash generated from operations and a substantial Free Cash Flow, indicating the company's ability to generate cash.

The increased cash outflow from investing activities indicates strategic investments for future growth.

The higher cash outflow from financing activities suggests Nvidia is likely returning more value to shareholders through buybacks or dividends.

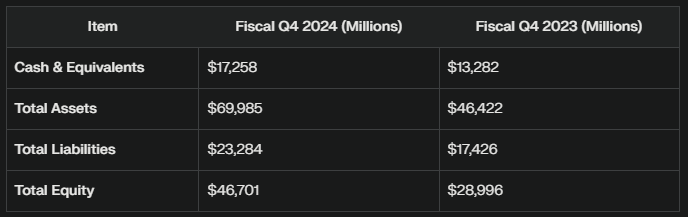

Balance Sheet Highlights

Nvidia’s financial strength is reinforced by increasing assets and equity. Here is how the company performed in Q4 2024 vs Q4 2023.

Partnerships

By February 2025, NVIDIA has partnered with top companies to expand AI.

These partnerships were announced at CES 2025, the JP Morgan Healthcare Conference, and Google Cloud Next ‘24.

Cloud Services

NVIDIA is working with Google to improve AI. Google will use the NVIDIA Grace Blackwell AI platform.

It will also adopt NVIDIA NIM inference microservices. The Blackwell platform will be available on Google Cloud in two versions: HGX B200 and GB200 NVL72.

Google and NVIDIA will offer up to $350,000 in Google Cloud credits to select NVIDIA Inception members.

Google Quantum AI is using NVIDIA’s CUDA-Q platform and the Eos supercomputer for quantum simulations. NVIDIA is also expanding DGX Cloud with AWS.

Healthcare

NVIDIA is helping healthcare companies use AI.

Amgen is using DGX SuperPOD for precision medicine. IQVIA is using NVIDIA’s AI tools to process over 64 petabytes of data.

Illumina is using AI to analyze genomic data. Mayo Clinic is developing new pathology models with NVIDIA’s technology.

Automotive

NVIDIA is working with automakers to build AI-powered vehicles.

Xiaomi, Li Auto, and Great Wall Motors are using NVIDIA DRIVE Orin™ and DRIVE Thor™ for smarter cars.

Toyota, Aurora, and Continental are developing self-driving technology with NVIDIA.

Retail

AI is coming to retail stores. Everseen is working with Google Cloud to improve shopping with computer vision.

AI Agents

NVIDIA CEO Jensen Huang calls 2025 the "year of AI Agents." These AI tools will help businesses work faster and smarter.

NVIDIA is offering NeMo, NIMs, and new Blueprints to help companies build AI Agents. These agents will analyze data, find insights, and take action.

Opportunities

Nvidia has significant growth potential, especially in the AI and machine learning sectors.

With AI chips accounting for 80% of the market share in 2023, Nvidia is well-positioned to benefit from the expected expansion of the AI semiconductor market, which is projected to reach $119.4 billion by 2027.

The data center and cloud computing markets also present significant opportunities for Nvidia.

As cloud computing continues to grow, Nvidia’s role as a provider of key infrastructure solutions for cloud services and data centers will likely expand.

The global cloud market is expected to reach $1.2 trillion by 2026, with Nvidia set to be a major player.

Emerging markets like autonomous vehicles and edge computing also offer new avenues for growth.

Nvidia is already positioned strongly in the autonomous vehicle semiconductor market, which is expected to grow to $34.5 billion by 2026.

Gif by snl on Giphy

Furthermore, Nvidia’s ongoing investment in R&D provides an opportunity for further vertical integration, enabling the company to strengthen its position in semiconductor design and manufacturing.

The company’s focus on high-performance computing, with applications across industries, will also drive growth, as demand for powerful computing solutions continues to rise.

DeepSeek Effect

DeepSeek's R1 model is impressive. It's almost as good as top models from OpenAI and Meta.

But it's much cheaper to run. DeepSeek focused on smart software, not just expensive hardware.

It's release has shaken NVIDIA and the AI world. NVIDIA's stock dropped sharply on January 27, 2025. They lost a huge amount of money.

In fact, it's not just one thing causing NVIDIA's stock to drop. It's more complicated.

People worried that companies relying on big AI hardware might be overvalued. Other tech companies also saw drops.

What does DeepSeek mean for NVIDIA? Maybe we don't need huge, expensive computers for AI.

If DeepSeek is right, NVIDIA's dominance might lessen. Or, maybe DeepSeek has limitations.

Then, AI will focus on inference. Inference also needs special chips, which could still mean competition for NVIDIA.

NVIDIA acknowledged DeepSeek's work. They say their chips are still needed for inference.

NVIDIA might need to change. They might need to make more efficient chips, cheaper chips, and more specialized AI solutions.

The AI world is changing. Inference is becoming more important than training. This means more companies will compete with NVIDIA. AMD and Intel might also need to adapt.

Geopolitics is also a factor. US-China tensions and chip restrictions could affect everyone. The US chip ban could limit DeepSeek.

But, some think DeepSeek's success could actually increase demand for advanced AI chips. It shows that good AI isn't just about having the most powerful hardware.

Other Risks

Nvidia faces several risks in 2025 that could affect its stock. One major concern is the difficulty tech companies are having in monetizing AI investments.

Many are pouring money into AI but aren’t seeing the returns they expected.

If this continues, they might scale back on spending, which could decrease demand for Nvidia’s AI chips.

There’s also the growing issue of an AI price war.

Companies like Alibaba are already cutting prices for AI services, which makes it harder for Nvidia to maintain its profit margins.

On top of this, geopolitical risks come into play.

If U.S. - China tensions escalate, particularly under a potential new Trump presidency, Nvidia could face restrictions, especially when it comes to selling high-power AI chips to China.

Gif by cbsnews on Giphy

As competitors improve in the AI chip market, Nvidia could lose some of its market share, and its profit margins might shrink.

Microsoft’s CEO recently mentioned that the company is no longer "chip constrained," suggesting they might find alternatives to Nvidia’s products.

Nvidia also experienced a significant decline in market capitalization in January 2025, losing nearly $600 billion in value when shares dropped by 17%.

This is a major concern, especially if it becomes a trend.

There’s a risk of a concentrated sell-off, which could lead to a larger market correction. Nvidia has also faced past stock crashes, and historical data suggests it could happen again.

Another risk is the uncertainty surrounding the costs of AI growth.

The DeepSeek R1 model could lead to a shift toward more cost-effective technologies, putting pressure on Nvidia and others to innovate and adjust their strategies.

Market saturation and rising competition in the AI training space might also limit Nvidia’s growth opportunities.

From a financial standpoint, Nvidia’s high price-to-earnings (PE) ratio is almost double that of the S&P 500, which means the stock is priced high.

If the expected earnings growth doesn’t materialize, Nvidia’s valuation could be at risk.

Additionally, the potential rise of quantum computing, although still in early stages, poses a long-term threat to Nvidia’s GPU architecture.

If big customers spend less money, Nvidia might not make as much money.

Also, if smaller AI models become more popular, Nvidia may need to change its products to stay competitive.

Here is the summary of all what we have covered above.

Nvidia’s Market Position

Strengths

✅ Dominance in AI & GPU technology

✅ Strong financial growth & brand reputation

✅ Strategic partnerships (AWS, Google, Amgen)

✅ Leadership in AI-driven data center solutions

Weaknesses

❌ High R&D costs impacting profitability

❌ Supply chain vulnerabilities

Opportunities

🚀 AI market projected to exceed $1.3 trillion by 2030

🚀 Cloud computing expected to reach $2.39 trillion

🚀 Autonomous vehicle market to grow to $448.6 billion by 2035

Threats

⚠️ Intensifying competition (e.g., DeepSeek AI, Alibaba AI)

⚠️ Geopolitical risks (China market restrictions)

⚠️ Market volatility in gaming & data centers

Love what you're reading?

Chasing.money is a small pub with big ideas. Help us grow! Share our newsletter with those who want the real story.

Reading this in your email? Forward it to your contacts and help us reach more people. Thank you for your support!

Check Out Our Sponsor

Claim your free Gold IRA Guide and discover the crucial steps to take when opening your Gold IRA!

Disclaimer: This newsletter is for educational purposes only and should not be considered financial advice. Always conduct your own thorough research before making any investment decisions.